Earlier this year, the European Commission finalised a report called “Study on options for development of online tools and services supporting retail investors in investment decisions” that was made available recently on its web site. This 10m EUR estimated project could take 4 years to be developed as illustrated in the document. The go-live could take place in 2025.

This project should be linked to the report issued by the High-Level Forum (HLF) on the Capital Market Union (CMU) suggesting ESMA to set up the European Single Point (ESAP). However, due to its anteriority, the proposal does not take into consideration the ESG information that will be a plus for the database and its users.

The authors of the report recommend starting with a limited scope of products: UCITS, AIFs and structured product in scope of PRIIPs while IBIPS, Personal Pension Products and structured deposits will be integrated on a later stage.

The report, based on the analysis of existing solutions and their targets, expert interviews and use cases, suggests the development of a database operated by a single body and accessible free of charge by retail investors as well as financial professional but also academics joining the advice of the HLF.

To made the online tool effective, the authors proposes to implement regulatory amendments to generalise the disclosure of the ISIN codes or any alternate reference codes , the LEI of the manufacturer, and the communication of the EPT/EMT data to the National Competent Authorities. On their turn, NCAs will feed the central database using xml format.

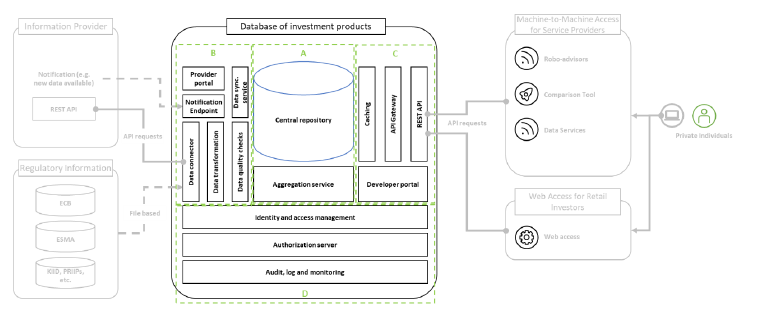

The Distributed Ledger Technology has been analysed and assessed to conclude that it is not the most relevant technology for that use for the time being. Instead, the preference has been given to distributed databases that offer a higher level of data integrity. The architecture of the database should be illustrated as below:

In addition to the description of the 4 macro elements (Core Database, Information Providers Interfaces, Services Providers Interfaces and Transversal Functionalities), the report provides for the list of data fields and their attributes.

One of the elements of success of this initiative is linked to the availability of independent truthful and comparable information on financial products.

In terms of comparability, the report suggests the disclosure of 2 new indicators. The first one, the “Risk-performance ratio at one year” will permit to answer the investor question “Based on the past performance of the PRIIP, how much could I profit from taking an amount of risk, in a one year time horizon? While the second indicator, the Loss ratio at RHP, will answer the question “Based on the past performance of the PRIIP, how much money do you stand to gain over 1 year for each €1 you are risking to lose?”

As regards to regulatory aspects, the report provides for the required regulatory changes that will permit NCAs to collect the information. As such, PRIIPs, MiFID, IDD needs some adjustments to reach this goal. We would suggest adding relevant information from Sustainable Finance Disclosures Regulation (SFDR) to match the wish expressed by the financial community on the publication of HLF recommendations on CMU.

According to the authors of the report, PRIIPs should also envisage amendments of the regulation to dematerialise the document and allow for electronic dissemination of KID/EPT to NCAs as well as feeding of member states of distribution. This principle is not utopic, it is worth to note that recently, the Italian capital market watchdog (Consob) has announced it will collect some EPT information on an ex-ante basis before marketing of PRIIPs and their revisions from beginning of 2021. We can easily imagine additional NCAs adopting the same conduct before its generalisation.

EPT: European PRIIPs Template – FinDaTex